INVEST

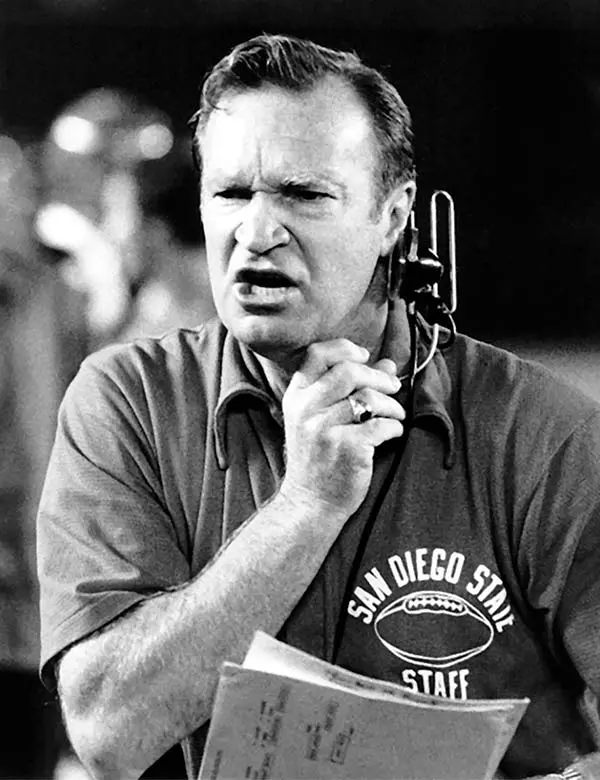

Coryell Legacy Society

Named after legendary Head Coach, Don Coryell, the Coryell Legacy Society recognizes all donors who have created an endowment, contributed $25,000 or more to an existing endowment, or have remembered SDSU Athletics in their estate plans.

Planned Giving and Endowments

Planned Gifts and Endowments help to ensure the future success and growth of SDSU Athletics.

Members of the Coryell Legacy Society are invited to an exclusive event each year to connect and engage with the student-athletes they support.

Leave a Legacy

A gift in your will or estate plans to support SDSU Athletics is a wonderful way to build a legacy. This future gift is an extension of your current commitment and support - one that will ensure a secure and brighter future for generations of Aztec student-athletes to come.

We will work with you to find a charitable plan that lets you provide for your family and support SDSU Athletics.

Recognizing Your Gift - Gift Confirmation

Gift Confirmation FormTo learn more about establishing an endowment or including SDSU Athletics in your estate plans, please call (619) 594-6444 or email us today.

Your Goal

- Estate tax charitable deduction

- Life use and ownership of your property

How it Works

- Estate tax charitable deduction

- Life use and ownership of your property

Your Benefits

- Estate tax charitable deduction

- Life use and ownership of your property

Your Goal

- Insurance policy no longer needed for its original use

- Receive charitable income tax deduction without giving cash

How it Works

- You designate SDSU as the beneficiary of your policy

- Designate SDSU as owner of your life insurance policy

Your Benefits

- Estate tax charitable deduction policy

- Current charitable income tax deduction with tax savings for up to six years

Your Goal

- Receive fixed income for life

- Receive the benefit of tax savings from a charitable deduction

- Pay Fewer Taxes

- Reduce or Eliminate Required Minimum Distribution

How it Works

- You designate SDSU as the beneficiary of your IRA

- Contact your IRA administrator to request a transfer from your IRA directly to SDSU

Your Benefits

- Continue to take withdrawals from your IRA during your life and then leave the remaining value to SDSU

- Bypass income tax liability from required minimum distribution

Your Goal

- Receive fixed income for life

- Avoid capital gains tax on the sale of your appreciated property

- Enjoy the benefit of tax savings from a charitable deduction

How it Works

- You transfer your cash or appreciated property to SDSU in exchange for our promise to pay you fixed income (with rates based on your age) for the rest of your life.

Your Benefits

- Charitable tax deduction

- Fixed income for life

- Partial bypass of capital gain

- Possible tax-free payments

Your Goal

- Transfer your appreciated property without paying capital gains tax

- Enjoy regular income for life or a term of years

- Receive the benefit of tax savings from a charitable deduction

How it Works

- You transfer your cash or appreciated property to fund a charitable trust. The trust sells your property tax-free and provides you with income for life or a term of years.

Your Benefits

- Charitable tax deduction

- Income for life or a term of years

- Possible income growth over time

- Avoidance of capital gains tax

Your Goal

- Give cash or property to your family in the future

- Avoid substantial gift or estate tax

How it Works

- You transfer your cash or property to fund a lead trust that makes a gift to us for a number of years. You receive a charitable deduction for the gift. Your family receives the remainder at substantial tax savings.

Your Benefits

- Gift or estate tax deduction

- Asset and appreciation passes to family at a reduced cost

Your Goal

- Establish a fund that allows you to give annually

- Recommend how the funds should be distributed

How it Works

- Contact us for an application form. You may fund your account with a gift of cash, securities, real estate or other asset.

Your Benefits

- Donor Advised Funds generally qualify for a full fair market value charitable deduction